|

|

Emerging economies such as Eastern Europe and East

Asia pose special challenges for managers aiming to enter attractive new

markets, or to exploit new opportunities of world-wide division of labour.

My research has over the years analysed various aspects of the challenges,

and I published papers aimed for different audiences. On this page I

provide a brief summary of papers that may be of direct interest to managers

involved in setting up businesses in emerging economies. Click on the button

below the abstract to download the paper.

Management Challenges of Chinese Multinationals

I have been blogging extensively on Forbes and EIU on

the strategies and managerial challenges of Chinese multinationals.

Following this link, you find a compilation of

my

blogs in 2015-2016.

Globalization Challenges: Is National Sovereignty

under Threat?

Multilateral Agreements between nation states are committing

countries to free trade - and many other things. Some of these

commitments have become the focus of anti-globalization campaigners.

While agreements such as TPP and TIPP have the potential to accelerate

economic growth, they trouble is in the detail, in particular in the

investment protection clauses aimed to protect foreign investors, but

creating constraints on national politics. To bring the debate over such

agreement into classrooms around teh world, we have edited in

2016 a special issue of AIB Insights, a newsletter of the

Academy of International Business.

Entry Strategies for Emerging Economies

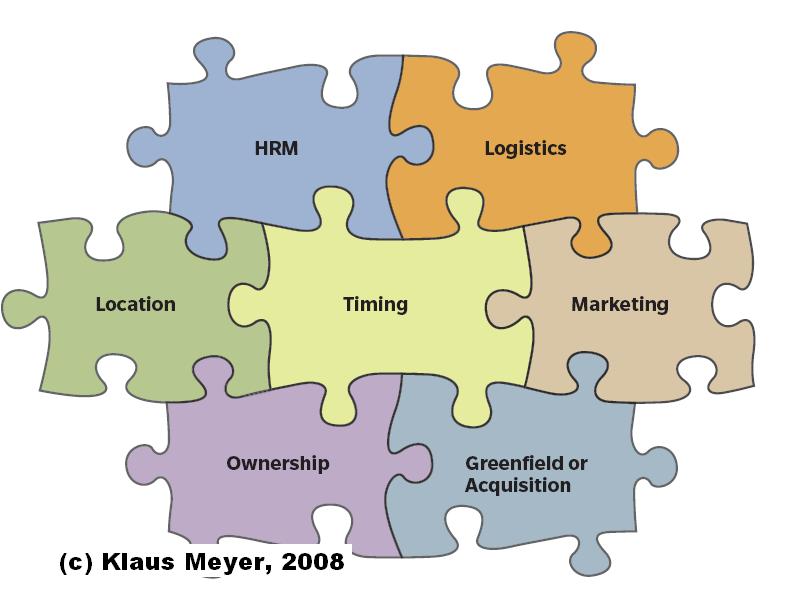

These two short papers outline an integrative approach to designing

foreign entry strategies. Entry strategies have many aspects that are

interdependent, including location, timing, mode and ownership,

marketing, human resources and logistics. By recognizing these

interdependencies, rather than taken decisions sequentially, investors

can design their entry strategies such as to get the new subsidiary

of to a good starting, thus laying the foundations of successful market penetration and profitable growth.

The item for the Bath Alumni newsletter provides a synopsis of the

challenges faced by companies contemplating foreign entry; the article in

the Princeton Encyclopedia provides a more scholarly overview.

| Meyer, Klaus E. (2008): Strategies for Emerging Economy

Markets, Bath Perspectives, March, in press. |

|

| Meyer, Klaus E. (2008): Foreign Entry Strategies,

Princeton Encyclopedia of the World Economy, in press. |

|

Market Penetration and

Acquisition Strategies for Emerging Economies Market Penetration and

Acquisition Strategies for Emerging Economies

Multinational enterprises (MNEs) are expanding their

global reach, carrying their products and brands to new and diverse markets

in emerging economies. As they tailor their strategies to the local context,

they have to create product and brand portfolios that match their

competences with local needs. Moreover, they

have to develop operational capabilities for the specific context, which

requires complementary resources that are typically controlled by local

firms. We outline strategies for penetrating local markets through

multi-tier branding and the acquisition of local firms. We discuss when to

target mass markets, premium markets, or both, and we offer new

typologies that differentiate acquisition entries by the aggressiveness: staged acquisitions, multiple acquisitions, indirect

acquisitions, and brownfield

acquisitions. We illustrate them by analysing the entry and growth of

Carlsberg Breweries in four very different emerging economies: Poland,

Lithuania, Vietnam and China.

| Meyer, Klaus E. & Tran, Yen Thi

Thu (2006), published in:

Long Range Planning, 39,

no. 2, p. 177-197. |

|

Doing Business in Vietnam

Over the last thirty years, Vietnam evolved from “war

after war” to an emerging economy with an attractive foreign investment

policy and commitment to a liberalized economy. Although the GDP per

capita is still considerably lower than in the Asian Tiger economies,

and the institutional framework still reflects inheritances from the

central plan system, Vietnam today has a vibrant economy with small

businesses springing up at every street corner. Foreign investors have

been flogging to Vietnam since the early 1990s, with a new peak of FDI

inflow in 2004. This paper reviews the Vietnamese economy, society,

culture, and policies towards foreign investment to inform those

considering to invest in Vietnam, and to provide some practical advice.

Foreign Direct Investment in Emerging Economies

This paper summarizes the literature on the role of FDI

in emerging economies. It focuses on the impact of FDI on host economies,

and on policy and managerial implications arising from this (potential)

impact. It addresses four questions:

- Why do multinational firms invest in emerging

economies?

- How does FDI affect host economies?

- What can governments do (better)?

- What can MNEs do (better)?

| Meyer, Klaus E. (2005), policy discussion paper in preparation for Emerging Markets Forum,

Templeton College, Oxford, December 2005 |

|

|

Managing partnerships with state-owned joint venture companies: Experiences from

Vietnam

Vietnam is gearing up to join the Asian Tigers. Business

opportunities beckon yet foreign investors often still need to

co-operate with local state-owned enterprises to gain access to

crucial local resources. This creates unusual management challenges.

We outline some of the key challenges arising in such relationships and offer

insight in how to manage them. |

| Nguyen, Ha Thanh & Meyer, Klaus E. (2004),

published in:

Business

Strategy Review 15 (2004), no.1, p. 39-50 |

|

Corporate Governance in

Transition Economies

|

| Meyer, Klaus E. (2003), published in: The Capco Institute

Journal of Financial Transformation, no. 9 (Nov), p.30-38 |

|

Management

Challenges in Privatization Acquisitions in Transition Economies

Large-scale

privatization was at the core of economic reform in most transition

economies, except China, in the 1990’s. Privatization creates

special challenges for multinational investors acquiring firms in

the process. Such acquisitions differ from conventional acquisitions

due to the constraints imposed on strategic action by the

privatization context, the depth of subsequent restructuring, and

the necessary sensitivity to the local context and the societal

changes associated with systemic transition. This paper reviews

privatization experiences in Central and Eastern Europe and the

former Soviet Union with the aim of identifying key issues for

managers operating in transition economies. |

| Meyer, Klaus E. (2002), published in:

Journal of World Business 37, no. 4, p. 266-276 |

|

|