Klaus Meyer's Blog

On Global Business and Economics in Volatile Times

My Blog

My homepage

2013

Two Ways to Discover the Black Swan

December 29, 2013

Story 1: Nassim Teleb's book 'The Black Swan' is a modern classic that I had long been wanted to read, if only I had more time to read. During the busy time between Christmas and New Year, I went down to the coffee shop where they hold a good collection of books for patrons to read. I was delighted to find Nassim Talen's 'Black Swan' on the shelf and without hesitation started reading. He describes in the most vivid ways how humans fail to appreciate probability and uncertainty, which leads them to take undue risks, and in extremis to the collapse entire financial systems. Taleb integrates the psychology insights of Daniel Kahnemann with the history of financial markets by Justin Fox (both reviewed elsewhere on this side) but sharing his insights more through stories and with little reference to supporting scholarly evidence.

Story 2: The other day, a friend of mine asked me to call her at a specified time because she had a blind date and was plotting a way out in case it didn't go well. When I called, she didn't pick up the phone; so she seems to have been lucky after all, and I had an unexpected free evening. I wandered down the road and passed by my local coffee shop. I spontaneously went in, ordered some dinner and ended up sitting right by the bookshelves. As my eyes wandered over the shelves, I wondered if there was something more interesting than the papers I had brought along, and my eyes fell on "The Black Swan". I had heard about this book, and was intrigued. I started reading, and soon ordered another beer, and read a few more chapters. Taleb has been a trader, and more importantly, he observed others win an loose money in the financial markets. What seems to have puzzled him most is how much people believe in their own skills, when all they really did was being lucky when taking high risk chances!

How do you tell your life's stories? Are your actions and achievements the logical outcome of your decisions and of your skills, or is it largely driven by fortuitous circumstances and good luck? Nassim Taleb struggles with this tension. Based on a combination of research and experience, he comes to the conclusion that in fact people tend to underrate the contribution of 'chance' - not withstanding, of course, that the proverbial 'prepared mind' is better at grabbing opportunities that chance would deliver. This is a consequence of human fallibility when it comes to handling probabilistic events. If you are in a habit of telling your life in the style of story 1 above (as most business persons or MBA students would), then you should read the Nassim Taleb - along with Daniel Kahnemann and Justin Fox.

The Investor, the Boss and the Mistress

December 26, 2013

Christmas parties are good for unconventional learning experiences. At an LBS Alumni Christmas dinner a newly minted graduate of the EMBA program asked us, "would you invest in a company if the CEO has a mistress?" Reactions around the table were mixed, asking "why not? what does the mistress have to do with finance?"

The ensuring discussion reminded me of some basic insight that I learned when I was in banking many, many years ago - more precisely in retail banking in local branches where loan businesses was often a couple of thousand deutschmark to a local craftsmen who may have a lot of tools and stock in his workshop, but hardly any securities that the bank would accept. The advice from the old banker was, "do all the formal check of the accounts whatever the topdogs in the bank want to see - but eventually what really matters is, do you trust that this guy is an honest person who will do all he can do repay the loan?" Investment into a personal business is always a matter of trust, and the financial accounts are at best a supporting tool to verify whether your trust is well placed.

The EMBA graduate explained his stance. He had recently met, and was very impressed by, Singaporean speaker and author, Yong Kwek Ping. His key argument was that in China, the personal trust in the individual that you are investing in, rather than the financial of the company is still key - not only for the sort of small town craftsmen I met in my youth, but for really big private companies. The key issue is that formal systems such as accounting, auditing, contract law, corporate governance and so on simply are not very trustworthy in China. In consequence, the person remains important. Yong Kwek Ping thus advises that the first question of due diligence for investors ought to be: Does the business owner have high standards of ethics? Any evidence of unethical behavior, such as having a mistress, gambling trips to Macao or suspiciously close relationship with politicians, thus is an indicator of risk. There is an excellent video of Yong Kwek Ping explaining his view of TED - a must see if you consider investing in China!

The broader question arising is whether today's bankers, who are trained in top university finance departments and have more knowledge about crunching numbers than you thought existed, actually have the right skills to invest in people?

IB failures: The Universalist and the Exceptionalist

December 12, 2013

Two very different types of managers are bound to stumble and fail in international business:

-

The universalist develops best practices in the core operations, usually their home country, and then rolls them out globally. Moreover, the universalist goes on business trips and negotiates deals with scant knowledge of local culture, local partners value systems, and the objectives of their business. Suffering from a universalism fallacy, he will be ripped apart by his business partners, and complain loudly about their perceive lack of ethics, and lecture them on how they ought to do business. Never mind that many universalists come from countries that performed less than stellar in recent years.

-

The exceptionalist believes in the deep historical, cultural and roots of his own country, and therefore rejects ideas, advice and proven best practice from other countries. Moreover, the exceptionalists will reject every idea from abroad, and often immigrants, fearing them to undermine the countries inherited culture. Suffering from exceptionalism fallacy, he will fail to stay up with modernization and innovation, fail to establish mutually beneficial relationships with foreign business partners, and eventually run to his government to beg from protection from the evil forces of globalization.

Sadly both fallacies are very common. We encounter the universalism fallacy especially among US-American business persons, but I have also seen it among the English and Germans, but less so among people from smaller nations. I have observed exceptionalism especially among Russians and Chinese, but they exist in many places. Both tendencies, paradoxically, tend to be stronger among politicians than among business persons (at least those I personally know).

The skill of the international manager is not to push global practices at any cost, nor to adapt to every local objection. The skill of the international manager is to integrate the global and the local, to create locally effective practices while exploiting the best of global practices. Effective international managers have a deep understanding of both their global organization, and of the local context in which they are operating.

This sounds easier that it is in practice. Most people have very little experience of actually living in different countries, and thus find it hard to appreciate how and why countries and cultures are different. These differences often concern very tacit knowledge that can only be acquired through experience, not from reading textbook, or TV documentaries. Even managers who are successful in one location have a hard time appreciating that the practices that brought them fame at home won't work elsewhere. Likewise, local managers encountering a foreigners are bound to react with a not-invented-here attitude to practices introduced by a foreigner, and locally unproven. The skill of the international managers is to bridge between the worlds of universalists and exceptionalists, or in fact to recruit people who can "look beyond the horizon" without "loosing their local touch!".

Chinese Women in the Global Workforce: Domestic Dilemmas

October 26, 2013

I had an interesting dinner conversation today with a (female) international manager. Her organization had the smart idea that they need to enhance the international experience of their middle managers, and hence they send two female employees on separate work assignments to Europe. The idea was that such international experience would enhance their ability to engage with foreign clients and colleagues and thus better as serve as bridges between cultures. v

The first consequence, however, was rather unexpected. Soon after their return both women filed for divorce. According to the international manager, they developed their personality and their view of themselves so much that they decided to take such a drastic change in their personal life. They discovered that as a women they could be so much more than what their husband would give them space for. Hence, they said, I can't change my husband, so better get a divorce. The international manager thus asked herself, "should I really arrange such international work experience programs for Chinese women if it has such a disruptive effect on their personal life?"

I would like to put this experience in a broader social phenomenon that I observe in Shanghai (but not necessarily elsewhere in China). Theoretically, there are more men than women in marriage-able age; yet there are many women over 30 in Shanghai who can't find an agreeable partner. Mostly these are educated women, including graduates from foreign universities such as I meet through Alumni associations of British universities. What explains this paradox? My theory is this. People under thirty mostly have grown up as only children, so don't have brothers and sisters, and hence have limited engagement with the opposite gender as they grow up. Thus, post-1980 men grew up as centre of the family, with their mother as their main female role model - typically a role subordinate to their husband. Post-1980s women also grow up as the centre of their family, and hence they develop very different personality than their mothers' generation: more focus on education and own achievements, and much more self-confident. So, the young men look for women who would support them like their mother supported their father - and can't find them. Young women look for men who are educationally their equal, and will respect them as a more or less equal partner in the relationship - and can't find them. It's quite a social challenge for unmarried people in their early 30s in Shanghai!

Will Myanmar Benefit from attracting Foreign Investors?

October 18, 2013

The Singaporean newspaper 'Today' carried an interview with me today, conducted by Htwe Htwe Thein of Curtin University, Australia. She is Burmese (i.e. originating from Myanmar), and her central concern was whether the rush of foreign investors to Myanmar after the recent opening would benefit or harm the country. This question is apparently hotly debated in the country after the country's spiritual leader, Aung San Suu Kyi, raised her doubts about the motives and contributions of multinational companies (MNCs).

In the interview, I tried to convey two messages,

-

Most of the negative effects that often are attributed to MNCs arise not from the MNCs per se, but from the ways they interact with the host government, the host country legal framework, and the law enforcement. Hence, the priority for the Myanmar government at this stage should be to build a solid legal framework, administrative competences in negotiating with MNEs, and non-corrupt law enforcement.

-

The social responsibility initiatives of many Western firms, and the social activism of some Western NGOs both have some impact on practices in economically less advanced economies. But in the broader picture their impact should not be overestimated. The lowest standards in areas such as labour, environment and corruption are not those of well known multinationals (that are hit by occasional negative press in Western media), but they are in companies of local origin or from non-Western origins that have little or no connection with Western consumers or activists.

Hence my conclusion, that Myanmar government needs to take responsibility itself for developing its institutional infrastructure. The full interview is available here: part 1, part 2.

Why are the Chinese investing in Icelandic North Sea Oil?

September 16, 2013

Chinese companies have been investing heavily overseas, acquiring businesses and other assets overseas, including some very remote locations (from a Chinese perspective). Recently, this investment drive has taken them as far as Iceland, where Chinese state enterprises invested in oil and gas exploration. What takes them so far afield?

First, it is official

government policy to seek resources overseas to secure supplies deemed

essential for national economic development, including natural

resources, like energy, as well as technologies and advanced know how.

Alignment with policy objectives is important to Chinese firms,

especially SOEs, as it is critical for their ability to obtain

financial and other resources within China. This Chinese quest for

resources has taken Chinese MNEs into places like Angola and Sudan,

where they invested despite apparent political and economic risk.

Investing in the North Sea is a natural extension of that as it

diversifies the risk.

Second, despite their huge size domestically Chinese MNEs are still at

early stage of developing their international business competences,

and advancing on a steep learning curve. Hence, they are eager to

learn best practices in the industry, in the case of Iceland perhaps

technologies related to the exploration of geothermal energy.

Acquiring businesses in advanced economies gives Chinese MNEs access

to technologies and management best practices that may help enhancing

efficiency in other operation. These objectives can to some extend be

achieved even as minority shareholder.

Third, China has huge currency reserves that it needs to invest. A

large share of these reserves is invested in US government

bonds, which is increasingly seen as a risky investment, especially if

the dollar continues to slide vis-a-viz the Chinese renminbi. Hence,

diversification of investments suggests to invest some funds in real

investment.

Fourth, there have been speculations about political motives behind

such investments. In geo-strategic politics, it always helps to

make friends, build relationships, and economic interdependencies with

other countries. There may not be any specific objectives behind the

extension of a hand of friendship to Iceland. Yet, like any other

country, China may some day be in a situation when friends may be

helpful to win a crucial vote in the UN or in the Arctic council.

Fifth, Iceland is quite open to new friendship, having been badly

treated by the UK in particular when it's banks went under (i.e.

Icelandic Tax-Payers made liable for private debts

of their banks abroad?, see my comment in January 2010).

Shanghai Taxi Seatbelts, and Law

Enforcement Chinese Style.

September 12, 2013

"A miracle has happened", I told a friend in January. "Since

the beginning of the year, all the taxis in Shanghai have FUNCTIONING

seatbelts on the rear seat". Previously, the norm seemed to be

that seatbelts are in working order only in the front passenger seat,

but not the rear seats, notwithstanding the automatic recording

instruction to passengers to "fasten your seatbelt". "Not much of a

miracle", my friend replied. "When the Shanghai government

charges the taxi company an insane fee for missing seatbelt, taxi

drivers very quickly find out how to keep their seatbelts in working

order." That was good news, of course, for people like me, whose

office is far from the nearest metro station.

But alas, by the end of January some drivers got lazy again, and

occasionally one would end in a taxi without seatbelt. Soon

it grew from occasionally to frequently, and by June it was essentially

back to where we were in December: the only taxis with seatbelts are

the few expo-taxis specifically designed for the 2010 EXPO (like the

second one on the picture).

The reason I am telling this anecdote is that it is symptomatic for law

enforcement in China (and probably some other places too). Every

now and then, there is a big campaign to address a particular

misbehaviour, with focused law enforcement, lots of publicity and big

fines. Such a campaign may be triggered by political agendas of the

national or provincial government, or by a scandal hitting the media -

which in China means going viral on weibo. However, a few weeks

later, all is back to normal, and few if any substantive changes

happened.

Two things are lacking, and you can call that institutional voids if

you like. First, there is a lack of general safety consciousness:

there is no social norm that would induce drivers to

keep seatbelts in working order to make passengers feel safe and well

served. Second, law enforcement is not consistent with for

example periodical random checks, but virtually non-existent unless

announced with a big campaign. Without informal norms supporting the

law, and consistent law enforcement, transgressions against the rules

will remain the normal in China. If it was just seatbelts I wouldn't

worry. But, the same principles apply also to some big issues faces by

businesses.

Compliance Management meets Corrupt Markets: GSK

July 27, 2013

Last week, news hit the world that one of the world's largest pharmaceutical companies, GSK, is investigated for corruption in China. Its Chinese employees had, so the allegation, confessed to designed a sophisticated scheme to channel bribes to doctors using a large number of travel agents. While initially skeptical, soon even the British media acknowledged that something went amiss in this iconic British company.

I have no insider knowledge into GSK, or of this particular case. However, based on many conversations in China, including with local and foreign businessmen, people in the health care sector and last not least my own students who did projects on companies aiming to sell to hospitals. Based on these conversations, in my mind, I have a clear scenario how this might have happened, which highlights the operational and ethical challenges for multinational enterprises (MNEs) selling into markets that like the Chinese health care market are prone to illicit practices.

From the perspective of the MNE, the situation may look straight forward. Laws in their home countries (if it is an OECD country) fairly clearly state that corruption in overseas affiliates is not only illegal, but can be prosecuted in the home country. Senior executives probably also genuinely believe that the world would be a better place without corrupt practices, and by being sneaky clean they may gain a reputation advantage that may help sales both at home and in other advanced economies (notably the largest market for pharma, the USA). Hence, MNEs introduce sophisticated rules that tell every employee what is and is not permitted when dealing with clients or officials around the world. This nowadays is known as compliance management, an important aspect of modern international management practice. An MNE may, for example, have instituted an online training course and exam that every employee has to go through upon joining the company, and once a year thereafter. Such a program ensures that every employee knows the rules - or at least that the MNE can claim to have done everything reasonable they would. The question, however, is, do the employees genuinely believe in the values communicated by compliance management, or do they just seen it as some bureaucracy they need to do to keep heir job? On this score MNEs certainly vary.

From the perspective of a doctor in a local hospital in China, the situation looks also fairly clear. They spend many years attaining a specialist education, and they work really hard under difficult condition to help the sick. In return they get paid very little indeed as their (official) salary. So, to afford a decent lifestyle in a society where status and material goods are important, they have to find other ways to make ends meet. Sales rep from the pharma companies, who by comparison are immensely rich, want them to prescribe their medicines. So, some deal must be possible, or? Of course, some things are possible, and legal. For example, doctors need to learn about the merits of newly available treatments, and (like everywhere in the world) pharma companies organize conferences on topical issues, and pay participants' expenses. Often such events take place in beautiful hotels or resorts to motivate doctors to attend. How carefully organizers check attendance I don't know.

From the perspective of a local employee, the matter is much less clear. On the one hand, the MNE insists on their compliance management, but many see this just as folks up in headquarters just don't understand "how business is done here". Local competitors acting without the constraints of HQ compliance management are far more flexible. No need to organize conferences to attain favors, just employ them to provide some consulting services, or in some other way pay them directly. At least that's what the sales rep hears, and perhaps his clients, i.e. doctors or procurement managers, exaggerate a bit. So, the sales rep has to choose - loose the sale (and hence his/her bonus, and his/her promotion), or invent something that pleases the client, yet is permitted under compliance management rules. And if HQ are too much "a pain in the neck" with "all that fuzz about compliance", then why not just quit the job and work for a local company?

In the case of GSK, the local sales organization seems to have been rather creative to address this dilemma. HQ says conferences are OK, but clients rather prefer cash than a mini-holiday that comes with a work attached. So, why not generate invoices that HQ compliance managers will accept, but save the trouble of the conference and pay the money directly to the clients? Ingenious as the scheme is, all that is needed is a few helpful travel agents to issue the invoices. My best guess is that practices such as this are not unique to GSK. However, there is one flaw. Sooner or later, there is going to be an anti-corruption campaign...

So, if this and other practices are common place in Chinese health care sector, why did it hit GSK? Two possible answers come to mind. First, it is politically easier for authorities to target foreign companies for illegal or immoral practices, and the media will be most helpful in bringing down high profile foreigners. Such an ethnocentric bias is found in many countries! Second, the biggest fish will find it most difficult to stay 'below the radar' of the media or the authorities, and MNEs are almost by definition big fish.

So what are the lessons to be learned?

1. Compliance management practices are only as good as employees attitude to it. Successful compliance management is based on shared values, not only the enforcement of rules unappreciated by local staff.

2. If you are operating in a market where illegal practices are common, either stay out, or make sure you employ better practices the average of your industry.

3. If you are big (say, by sales), or if you are a foreigner, you need to be more careful in respecting the law than a mom-and-pop corner store.

Building a Brand in Traditional Chinese Medicine

June 23, 2013

Traditional Chinese Medicine (TCM) is different from modern Western medicine in two fundamental ways. First, TCM is a high degree preventive: patients would seek the doctors advice before they fall ill, and receive a combination of life-style advice, including exercises, nutrition advice, and (possibly) medicines or supplementary foods that aim to enhance the general 'balance' of the body. For example, my health insurance in China pays an annual health check up that generate a length report with lots of data that not only allows for routine checking of all kinds of illnesses, but tracing of indicators over time. In contract, European medicine - as I know it from the UK and Denmark - is by and large reactive: Unless you are seriously ill, the doctor will tell you "don't worry", and send you home.

Secondly, TCM builds to a high degree on experiential knowledge that has been passed down from one doctor to another over the centuries - many prescriptions trace their roots over a thousand years back. Pharmacies provide blends of (dried) herbs, insects, animal parts and sometimes minerals, and that gained a reputation for preventing or remedying physical ailments. Modern Western pharmaceuticals in contrast design their pills based on large scale tests of specific natural or artificial ingredients, that scientifically prove both the efficacy and safety of a medication (i.e. it helps against a names ailment, and does not cause undue side effects). TCM generally lack such scientific evidence of efficacy, though as I understood there is a licensing procedure aimed to ensure safety.

Without scientific proof that a medicine works, how can you build a business from it? The key factor for traditional medicine (Chinese or otherwise) is the trust of the consumer in both the traditional medication as such, and in the pharmacy's brand. I visited today one company that has made a success of TCM by building a brand based on the ancient values of TCM, Leiyunshang (上海雷允上药业西区有限公司). Entering their multi-story sales outlet in Shanghai, on the ground floor you find items like dried insects that set you back several hundred dollars a box, and pills made from such insects for an even steeper price tag. There strategy includes for example:

-

Positioning in the absolute premium segment - which in China to a large extend is a gift-giving segment,

-

Innovating new products, such as a pill condensing an insect popular in TCM.

-

Decor that emphasizes traditions of Chinese medicine as well as symbols of longevity; some calligraphy was made by famous doctors or calligraphists aged over 90.

-

A clinic that creates an atmosphere of a traditional doctor's home, yet in a modern setting, with locally known doctors providing advice.

-

Selectively selling top-end Western brands of medical devices such as Bayer, Philips, Siemens ad GN ReSound.

-

Emphasizing values of quality and trust in their corporate communications.

As TCM regains popularity in China, and is building a substantive niche market. Companies like Leiyunshang have to emphasize building trust in both their brand and the broader ideas of TCM, which is a challenge in a country where trust in local brands generally is not high. To start with, the company does not control its corporate brand - there are four companies using the name Leiyunshang that all trace their roots to the same 17th century pharmacist. So pity the consumers who get confused by bad press for a company with (almost) the same name up river in Suzhou. All of them are partially 'state-owned' but controlled but by disconnected entities.

Moreover, taking this business model beyond China may be an even bigger challenge because in other countries regulatory approval will require demonstrating efficacy and safety in large scale clinical trials. Hence, overseas opportunities may be limited to the segment of nutritional supplements rather than pharmaceuticals.

Eventually tried myself; what would the TCM doctor recommend for me? The doctor felt my pulse, looked at my tongue, played with my finger nails, looked in my eyes, and asked some simple questions. Then his verdict: nothing wrong with you, no need for any medicines. So, I am afraid I cannot report whether the medicine actually works.

EU Exports to China: Fascinating Trends

June 14, 2013

I recently did some

analysis of EU exports to China: While lots of journalists are talking

about Chinese exports, companies from some places are

actually quite successful selling in China. Total exports from the EU to China

have grown from in 2000 to in 2011, an increase of 427% (i.e. in 2011 EU firms exported more than 5 times as much as in the year 2000). I

obtained the data from

eurostat,

where they are available for free download.

I recently did some

analysis of EU exports to China: While lots of journalists are talking

about Chinese exports, companies from some places are

actually quite successful selling in China. Total exports from the EU to China

have grown from in 2000 to in 2011, an increase of 427% (i.e. in 2011 EU firms exported more than 5 times as much as in the year 2000). I

obtained the data from

eurostat,

where they are available for free download.

The first Figure, "EU Exports to China" shows the share of exports from different EU countries in the total exports from the EU, you can think of this as a market share (except that the actual market is of course much bigger). When I first obtained these numbers, I was surprised how dominant Germany is in EU exports to China: Almost every second RMB spend on imports from the EU is spend on good from Germany. The German share has grown continuously from 37% in the year 2000 to 47.5% in the year 2011. I cross-checked this by looking at the corresponding Chinese Import statistics and obtained the same pattern - Germany accounts for 44% rather than 47.5% in the Chinese statistics.

Of course, exports from all

other countries have grown too - after all the total exports are of a

much larger magnitude. But German firms have been more effective in

taking advantage of market opportunities. The next biggest exporters

to China are France and Italy and the UK with a

'market' share of 9.9%, 7.3% and 7.2% respectively. Switzerland is not

contained

in

the EU database, but Chinese data suggests that Switzerland

actually exports slightly more than France.

in

the EU database, but Chinese data suggests that Switzerland

actually exports slightly more than France.

The next Figure "Exports to China" shows how important as an export market for different European countries. The data show that 6.1% of German exports went to China, which is almost twice as much as the weighted average across all EU countries of 3.1%. Hence, the large share of Germany in EU exports is a combination of both the size of the German economy and its exports AND the relative importance of China within those German exports.

Finland and Sweden also have a very strong China-orientation in their trade pattern, though as smaller countries they do not command a bg share in the total trade. In the year 2000 Finland in fact had the highest China-orientation of all EU countries in terms of , and accounted for 5.7% of the market share (Sweden 7.9%). The relative decline of Nokia as a driving force of Finish exports may be a reason for both the pattern of Finish exports.

Another country that I find remarkable in the Figure is Slovakia, which has the highest China-orientation of all Eastern European countries at 2.6% (next highest are Estonia at 1.7% and Hungary 1.5%). What distinguishes Slovakian trade? I am not an expert on Slovakia, and I welcome others' opinion. However, I believe Slovakia has over the past 20 years established a strong base in the automotive component industry, which is tightly integrated with the main brands made in, for example, Germany. So, when VW, BMW et al. manufacture cars in China, they may well draw on the same supplier base as they do in Europe, which strongly relies on Slovakian and Hungarian factories.

On the other end of the spectrum, it seems that Portugal is least China oriented in Western Europe, while Lithuania, Slovenia and Latvia have the lowest score overall. To some extend this reflect that for a smaller country a lot of trade with local neighbours is in fact international, which means the share of intra-EU trade is smaller. But they may miss opportunities (compare for example to Estonia).

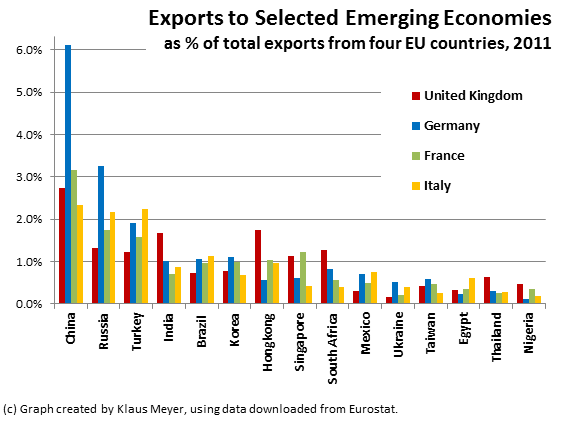

The

third Figure "Exports to Selected Emerging Economies" puts

exports to China in a comparative perspective by reporting the

relative share of exports to the ten most important export

destinations from the EU among newly industrialized and emerging

economies for the four largest EU economies. China is the most

important emerging economies followed by the other BRICs (Russia,

India and Brazil) as well as Turkey.

The

third Figure "Exports to Selected Emerging Economies" puts

exports to China in a comparative perspective by reporting the

relative share of exports to the ten most important export

destinations from the EU among newly industrialized and emerging

economies for the four largest EU economies. China is the most

important emerging economies followed by the other BRICs (Russia,

India and Brazil) as well as Turkey.

The data in this Figure show some clear proximity patterns (e.g. Germany in Russia, Italy in Turkey and Egypt) as well as historical relationships (UK in India, Hong Kong and South Africa). Some East European countries also have very strong trade ties with Russia and Ukraine grounded in their historical relationship. However, comparing data for 2000 with 2011 (which I did not create a Figure for), I observe that the importance of proximity and historical ties has been declining over time, leading to less idiosyncratic trade patterns.

I believe these data raise some interesting questions as to the determinants of international trade flows, and how these determinants have been changing over time.

Capital Intensive Goods in International Trade

June 12, 2013

Traditional models of international trade, especially in the field of development economics, have been based on the assumption that industrialized countries are rich in capital, whereas developing countries faced a shortage of capital. Hence, these textbook models predicted that industrialized countries had comparative advantage for goods produced in capital-intensive production, whereas developing countries had comparative advantage for goods produced in labour-intensive production. These comparative advantages, according to the factor endowment theorem drive international trade: countries export goods that require input of whatever factor of production a countries has in comparative abundance. The basic assumption then was that industrialized=capital intensive and developing=labour intensive, and hence the prediction that industrialized economies would export capital (and human capital) intensive products while developing countries would exported labour (and natural resource) intensive goods. from industriincluding the developing aid policy towards developing countries.

These simple assumptions were quite useful to explain trade patterns throughout the 20th century. But, they no longer apply today. The situation has changed fundamentally, only with respect to China but also parts of the Middle East. Based on two decades of trade surpluses, China, Saudi Arabia and others have accumulated huge international reserves. Moreover, domestic capital markets make capital available to firms, especially large state firms, at relatively low costs of capital. Even though the governance of state enterprises in China has changed in recent years such that persistently loss making enterprises longer receive seemingly unlimited subsidies, the state as owner (or SASAC as representative of the owner) only expects comparatively small payments of dividends.

In contrast, businesses in the traditional industrialized economies expect fairly high rates of profitability, especially those owned by outside financial investors. Their focus on short-term financial indicators encourages high-risk-high-return type investments, discourages long-term investments that only pay-off in the longer run. This financial system thus is not supportive capital-intensive industries with high that large large investment in fixed assets such as chemical plant or a steel mill, and hence high sunk costs and long pay back periods. At the same time, bank loans have become more difficult to obtain due to the consequences of the financial crisis, in particular the increased equity requirements that banks have to provide under Basel II and Basel III when they lend to industry.

As a consequence of these trends, capital intensive businesses in Europe no longer have a comparative advantage. Historically, the relative abundance of capital in Europe, the US and Japan provided the basis for exports of capital intensive products, for example in the chemical industry or the iron and steel industry. However, as China and a number of natural resource exporting countries become capital-rich, they will build comparative advantages in these industries. This effect is reinforced by a) the location of key customer industries in e.g. China, b) the availability of energy and petrochemical raw materials in the Middle East, and c) the lesser political opposition to large industrial projects in these countries. Since it takes several years to build a chemical plant or a steel mill, this effect takes a while to become fully visible. But investments in these sectors are up in emerging economies – and it is only a question of time until these industries will move out of Europe and North America. Steel is basically gone apart from small specialties, chemicals may well follow.

What can be done about that? On the policy side, enhancing the effectiveness of capital markets to provide long term capital will be essential. On the business side, focusing on products that are not only capital but human capital intensive will make it that the competitive advantage may be sustainable.

Understanding Post 1980s Chinese

May 13, 2013

The post 1980s generation in China is often seen as a major challenge for businesses. The new generation is different their elders, more so than in other countries, suggesting major social changes under way. They grew up in a very different environment that their parents and grandparents, including - among other features - youth in relative affluence, spoiled as single child, bearing the expectation of generations, and growing up with the internet as an integral part of their identity. The challenge of understanding this new generation often comes up in conversations with business people here (both local and foreign): they are eager consumers but they are apparently also difficult to please employees (and students).

Last Sunday, I wondered into a small art gallery near Fushing Park in Shanghai (named Longmen Art Projects) where they show pictures of an artist by the name of Luo Dan born in 1981 in Chongqing. Looking at these pictures, I immediately felt he is capturing the spirit of the post-1980s generation. Words that came to my mind include: fun-loving, aggressive, individual, proud to be Chinese (but selective what heritage to draw on), proud to be part of global pop culture (but putting your own twist into it).

Below are a few pictures that I took off the exhibition catalogue (click on them to enlarge) - the originals are about 1.5 meter squared. What do you see in these pictures?

|

|

|

|

As of today, the website of the gallery (www.longmenartprojects.com) does not have anything on this exhibition. However, there are pictures from an earlier exhibition of the artist Luo Dan in 2011.

Enhancing Relevance of Management Research in Asia

May 10, 2013

A long standing concern of mine has been the relevance of research conducted at leading universities in Asia that aim to be recognized as internationally leading universities, and aim to demonstrate that their research is of international quality. In consequence, Asian universities have adopted journal rankings used at leading universities in, for example, North America. The most popular of these lists is known as FT45, which in my opinion is better than others I know because it is more eclectic, but even this has mostly US-based journals with a small number of UK-based ones. Other good lists are those of the Australian Business Deans Council and the UK-based Association of Business Schools. Looking beyond the national borders is certainly important when it comes to research, and ought to be encouraged.

However, most universities in Asia also have a mission to do locally relevant research (at least their stakeholders - taxpayers and local businesses - would expect that). That also is very reasonable as it is more and more clear that we cannot simply take insights on how one society works, and assume lessons learned are relevant in another society.

However, the two objectives conflict with each other: The common journal lists tend to have ethnocentric biases, most notably US business schools hard ever recognize work published outside the US. No doubt, the most highly regarded journals are published in the US, with a small number published in Europe. However, to publish in those journals one has to write what is of interest to the journals editors and reviewers. Working with US data thus makes it easier to publish in those journals. Moreover, when working with non-US data, reviewers (and less so editors) are interested in generalizable insights that apply elsewhere, or of relevance to US businesses. This implies that research exploring local phenomena, or aspects of societies where generalization is not valid, does not get done, or at least is not recognized. Hence, many researchers in top Asian universities face strong incentives to work with, for example, US data, or - if they work with local data - to focus on generalizable effects, even if they are of limited explanatory power locally. Weather or not that is a problem varies across sub-fields. However, in all areas where culture, politics or institutions play a role, generalizations from one society to another are speculative at best!

I have argued about this issue several times (in: APJM 2006; APJM 2007, JIBS 2007, AIB Insights 2013), but the trend in the highest rated journals in the management field is if anything pushing even harder for "general theory", while discouraging careful discussion of the boundary conditions of theorizing. The obvious solution to this dilemma would be to enhance local relevance to creating an Asian list of journals that henceforth be used for promotion purposes in Asian business schools, and that adds to the lists used elsewhere a small number of high quality journals relevant in Asia. Ideally, this would be a joint initiative by the deans of several leading Asian schools to draw up a common list - and by encouraging more research to target these journals, they would soon rise to even higher standards. I have mentioned this idea to key people in the pertinent universities, but it is met with little enthusiasm among the deans who are surprisingly often US-educated because a) they are more concerned about how they are seen by their US-peers than by the local community and b) having rising by existing performance standards, they are not interested to change those standards.

However, I believe that in recent years the quality of locally relevant journals has risen such that the idea of a Asia list now is realistic. To move the discussion forward, I would like to hereby propose that Asia-based adopt an Asia-list of journals to the journal list they use for tenure and promotion purposes (perhaps giving them half the weight they give to FT45 publications), and this list to include the following five journals:

-

Asia Pacific Journal of Management (Management)

-

China Economic Review (Economics)

-

China Quarterly (Politics & Society)

-

Journal of Comparative Economics (Economics)

-

Management and Organization Review (Management)

This list is based on many conversations with scholars in the field, and a review of their citation impact scores. Unfortunately, I did not find suitable journals in the finance and accounting fields. I hope you will share this list with the relevant committee in your university, so together we can enhance the relevance of management research in Asia!

Executive Study Tour

March 22, 2013

Waking up, opening the curtains, I thought I must be in the wrong place. I arrived late last night, being transferred from the airport from the hotel after dark. I am supposed to talk to a very caliber of EMBAs from one of the Europe's leading universities on a China study tour, sharing with them insights on global business, and China in particular. As my eyes wander through the early morning mist over the ocean at this beach resort, I praise the privilege of working in such fantastic environments with with such interesting people.

It has been a busy, informative week for these executives; in addition to lectures and case discussions led by professors, they visiting a good cross-section of leading local and foreign invested companies, and they had an impressive range of speakers. The discussions in the classroom reflect both the depth of experience of the participants, and the rich new insights gained during the week. A thoroughly horizon-widening educational experience!

And yet, as watch people in the hotel lobby, I feel something is missing. We are all part of a 'global jet set' - both the course participants and local guests here. But, the global perspectives and life styles we have in common is not shared by the majority of people who have much narrower experiential horizons. Will these executive really be able to appreciate when I tell them, "the biggest growth in China is in tier 3 and tier 4 cities", "winning in the good-enough market is not just about lower price, but about entirely different ways of engaging with clients", or "the people you may be leading one day are deeply embedded in their local communities"?

I wish I could take some of these executives for a little walk, just a few blocs down the road from where I live, to show them a different China, the China of people who are not leaders of their businesses, but who just life ordinary lives, rush to work on the metro, eat at street stalls, or dance in the park.

Note: C-numbers link to chapters in: M.W. Peng & K.E. Meyer, 2011 International Business, London: Cengage.

2017

2016

2015

February 2014

January 2014

- Chinese Unity meets European Fragmentation C8

- Chinese MNEs learn to manage acquisitions overseas C11

- Why is it so tough to study Strategy? C13

December 2013

- Two ways to discover the black swan C6

- The investor, the boss, and the mistress

- IB failures: The Universalist and the Exceptionalist C4

October 2013

September 2013

- Why are the Chinese investing in Icelandic North Sea Oil? C6

- Shanghai Taxi Seatbelts, and Law Enforcement Chinese Style C2

July 2013

June 2013

- Traditional Chinese Medicine C3, C17

- EU Exports to China: Trends C5

- Capital intensive goods in international trade C5

May 2013

- Understanding post-1980s Chinese through their art C4

- Enhancing Relevance of Management Research in Asia

March 2013

December 2012

October 2012

September 2012

June 2012

May 2012

- Of lions and antelopes in Africa C13

- When people don't trust their own kind C3

- Eurozone: Could Germany do more? C9

- Eurozone: Grexit and other nonsense C9

- Facebook Shares Down, so What?

- Local Brand, Global Brand, and Cardiff FC C17

April 2012

- Maersk McKinney Moeller C17

- Interviews in a Coffee House?

- How to copy German manufacturing success? C03

- CSR: Whose fault are low labour standards? C10

March 2012

February 2012

- Why are journals biased against qualitative research?

- Is Shanghai more like London than like Moscow? C1

January 2012

- Cultural Identity: The Sports we Watch C3

- Starbucks: Measuring and Benchmarking Performance C15

- DOWN: Blackberry, Nokia; UP: Apple, Samsung, HTC

- Happy New Year 2012!!!

December 2011

- Predicting the Future 2012

- Amsterdam to Berlin! and London? C8

- 27-1: Why the UK Exit would be good for Europe C8

- No alternative to the euro! C8

- What went wrong with the euro? C8

- European Brand Value in China C12

- The World's Coffee Shops C10

November 2011

August 2011

July 2011

- Limits to outsourcing C4

- Downward Spiral? UK Loosing Equality of Opportunity

- Can engineers really become entrepreneurs?

June 2011

- Culture Matters in Unexpected Ways C3

- European Crises: UK vs Greece C8

- Chinese Capitalism C2

- Estonian Capitalism C2

May 2011

April 2011

- Business in the long run: Beecham

- Alternative Vote System (2): Qui Bono

- Alternative Vote System (1): Changing Dynamics

March 2011

- Freak o'Management (Freek Vermeulen) C14

- LSE and the Business of Fundraising C9

February 2011

January 2011

December 2010

November 2010

October 2010

- Policy Priorities: Denmark versus UK C2

- Understanding Consumers Worldwide C17

- Global Cosmopolitans C1

- Experiencing Organizational Change after the Crisis C15

September 2010

August 2010

July 2010

June 2010

May 2010

April 2010

January 2010

December 2009

November 2009

September 2009

August 2009

July 2009

June 2009

May 2009

April 2009

-

Should the U.S. learn from (the IMF's experience in) Russia?

-

Observations in a Toyshop: The Future of British Engineering

March 2009